In the world of forex trading, having a well-defined strategy is crucial to achieving long-term success. Many traders enter the market with high hopes, but without a clear plan, they may find themselves struggling to make consistent profits. That’s where effective forex trading strategies come into play. In this article, we will explore various strategies that can help traders navigate the forex market more effectively. For a comprehensive guide on trading strategies, check out forex trading strategies Trading Cambodia.

Understanding Forex Market Dynamics

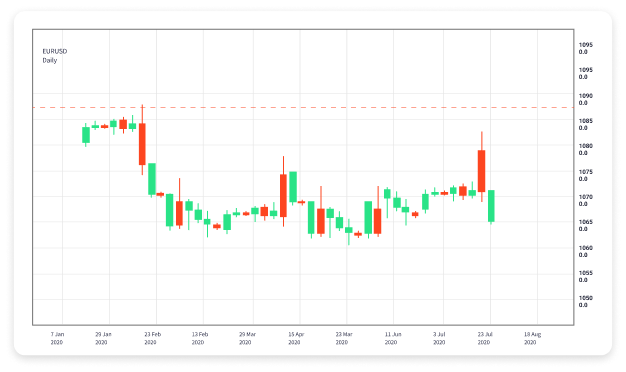

Before delving into specific trading strategies, it’s important to understand the dynamics of the forex market. The forex market operates 24 hours a day, five days a week, providing ample opportunities for traders to engage in currency trading. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, are heavily traded and offer high liquidity, which can lead to lower spreads and faster transaction times. However, the market can be volatile, and understanding how external factors such as economic indicators, geopolitical events, and central bank policies affect currency values is essential for successful trading.

1. Trend Following Strategies

One of the most popular approaches in forex trading is trend following. This strategy relies on the idea that prices tend to move in trends over time, whether upward, downward, or sideways. Here are some key techniques within trend following strategies:

- Moving Averages: Traders often use moving averages to identify trends. The most common moving averages are the simple moving average (SMA) and the exponential moving average (EMA). A common strategy is to buy when the short-term moving average crosses above the long-term moving average (a bullish signal) and sell when it crosses below (a bearish signal).

- Trend Lines: Drawing trend lines on a price chart helps traders visualize the direction of the trend. By identifying higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend, traders can determine entry and exit points.

2. Range Trading Strategies

In contrast to trend following, range trading strategies focus on currencies that are moving within a defined range. This strategy can be particularly effective in sideways markets where price oscillates between support and resistance levels. Here are some techniques for effective range trading:

- Identifying Support and Resistance: Traders identify key levels of support (the price level where a downtrend can be expected to pause) and resistance (the price level where an uptrend can be expected to pause). Entering trades near these levels can increase the likelihood of success.

- Oscillators: Tools such as the Relative Strength Index (RSI) or Stochastic Oscillator can help traders identify overbought or oversold conditions. When the RSI indicates that a currency is overbought, traders may sell, while oversold conditions suggest a buying opportunity.

3. Breakout Trading Strategies

Breakout trading involves entering a trade at the moment the price breaks through a defined support or resistance level. This strategy aims to capture strong price movements that often follow breakouts. Here are some key components:

- Pre-Breakout Analysis: Analyzing price patterns and volume can help traders predict potential breakouts. Common patterns include triangles, flags, and head-and-shoulders.

- Setting Stop Loss and Take Profit: To manage risk effectively, traders should always set stop-loss orders to prevent significant losses if the breakout fails. It’s also wise to set take-profit levels to secure gains when the market moves favorably.

4. Fundamental Analysis in Forex Trading

While technical analysis focuses on price movements and patterns, fundamental analysis looks at underlying economic factors. Understanding economic indicators, such as GDP reports, employment data, and inflation rates, is essential for making informed trading decisions. Here’s how fundamental analysis can enhance your trading strategy:

- Economic Calendars: Traders should utilize economic calendars to stay informed about scheduled economic releases and events that can impact currency values.

- Central Bank Policies: Monitoring monetary policy announcements and interest rate decisions from central banks can provide valuable insights into potential currency movements.

5. Risk Management Strategies

Regardless of the trading strategy employed, effective risk management remains a cornerstone of successful forex trading. Here are essential risk management techniques:

- Position Sizing: Determine the appropriate position size based on your account size and risk tolerance. A common rule of thumb is to risk no more than 1% of your trading capital on a single trade.

- Diversification: Avoid putting all capital into one trade or currency pair. Spreading investments across different assets can help mitigate risk.

- Regular Review and Adjustment: Regularly reviewing your trading performance and adjusting your strategies as necessary can enhance overall results.

Conclusion

Developing a robust forex trading strategy is essential for success in the forex market. By understanding the various approaches, including trend following, range trading, breakout trading, and fundamental analysis, traders can tailor their strategies to suit their unique objectives and risk tolerance. Additionally, incorporating effective risk management techniques is crucial for protecting capital and ensuring long-term profitability. Remember, the key to becoming a successful forex trader lies in continuous learning, practice, and adapting to ever-changing market conditions.